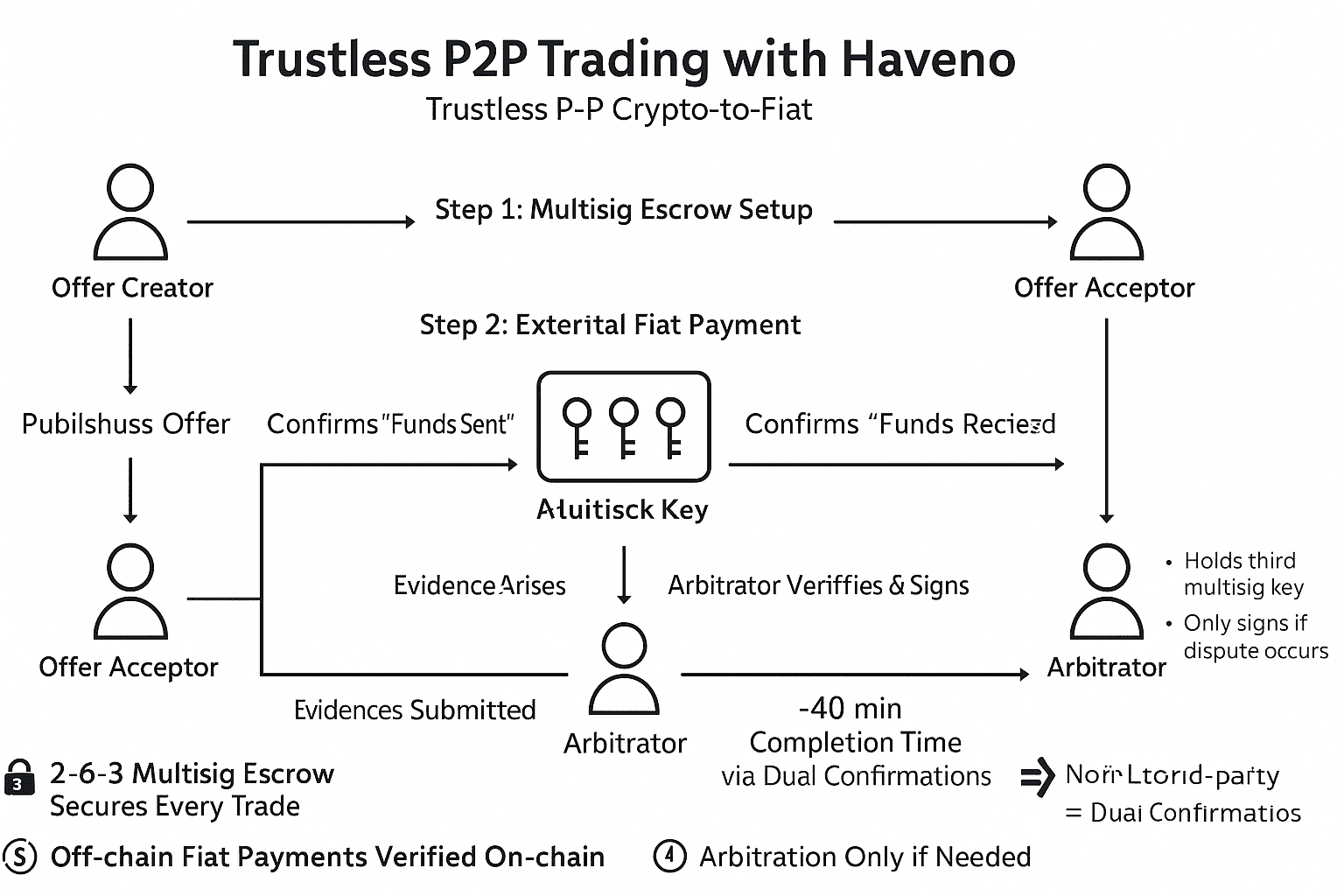

Platform Architecture

A peer-to-peer exchange network enabling direct cryptocurrency/fiat transactions without intermediaries. Participants engage in atomic swaps where:

- XMR serves as primary settlement currency

- All trades secured through cryptographic deposits

- Dispute resolution handled by independent arbitrators

Multisignature Security Implementation

Core Mechanism

Transactions utilize Monero's 2-of-3 multisignature protocol:

- Three cryptographic keys generated per transaction

- Two signatures required for fund release

- Key distribution:

- Trading counterparty A

- Trading counterparty B

- Designated arbitrator

Operational Workflow

-

Deposit Locking

- Both participants lock XMR deposits in multisig escrow

- 20-minute blockchain confirmation period

-

Trade Execution

- Payment coordination occurs externally (bank transfers, crypto networks)

- Platform tracks fulfillment through user confirmation:

- Payment initiator: "Funds Sent"

- Payment recipient: "Funds Received"

-

Settlement

- Successful verification triggers automatic escrow release:

- Traded XMR to buyer

- Security deposits returned (minus platform fees)

- Successful verification triggers automatic escrow release:

Participant Roles

| Role | Responsibilities |

|---|---|

| Offer Creator | Lists exchange terms Locks XMR collateral |

| Offer Acceptor | Accepts published terms Matches collateral deposit |

| Arbitrator | Neutral dispute resolver Holds emergency signing key |

Transaction Lifecycle

- Offer Creation & Funding (Creator)

- Offer Acceptance & Funding (Acceptor)

- Multisig Escrow Establishment

- External Payment Execution

- Mutual Confirmation Protocol

- Automated Settlement or Arbitration

Critical Features

-

Non-Custodial Design

Users retain wallet control throughout transactions -

Collateral System

- Mandatory security deposits from both parties

- Forfeiture conditions: Protocol violations

-

Contingency Protocol

Arbitration activation requires:- Mutual consent escalation

- Evidence submission

- Cryptographic proof verification

Operational Notes

-

Transaction Finalization

Typical completion within 40 minutes (dual blockchain confirmations) -

External Payment Risks

Platform monitors but doesn't control external payment channels -

Fee Structure

Service charges deducted from returned deposits

This architecture enables trustless trading through cryptographic guarantees and economic incentives, maintaining user sovereignty while preventing malicious behavior.